A cost that is included in the economic concept of opportunity cost, but that is not an explicit cost, is called an implicit cost. Gortari could get from producing carrots will not appear on a conventional accounting statement of his accounting profit. The income he forgoes by not producing carrots is an opportunity cost of producing radishes.

Gortari could earn $250 per month in accounting profits. Suppose the most valuable alternative use of his land would be to produce carrots, from which Mr. Gortari were not growing radishes, he could be doing something else with the land and with his own efforts. Gortari, the radish farmer, would subtract explicit costs, such as charges for labor, equipment, and other supplies, from the revenue he receives.Įconomists recognize costs in addition to the explicit costs listed by accountants. It is the measure of profit firms typically report firms pay taxes on their accounting profits, and a corporation reporting its profit for a particular period reports its accounting profits.

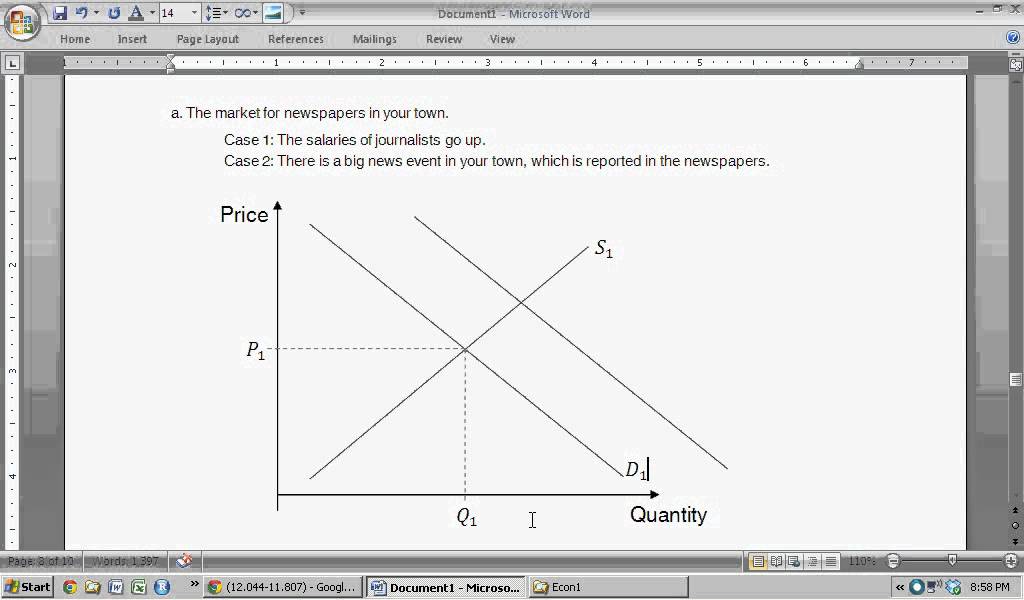

Profit computed using only explicit costs is called accounting profit. Explicit costs include charges that must be paid for factors of production such as labor and capital, together with an estimate of depreciation. An economic loss (negative economic profit) is incurred if total cost exceeds total revenue.Īccountants include only explicit costs in their computation of total cost. We shall see in this section that the model of perfect competition predicts that, at a long-run equilibrium, production takes place at the lowest possible cost per unit and that all economic profits and losses are eliminated.Įconomic Versus Accounting Concepts of Profit and LossĮconomic profit equals total revenue minus total cost, where cost is measured in the economic sense as opportunity cost. New firms can enter any market existing firms can leave their markets.

In the long run, a firm is free to adjust all of its inputs. Explain the effect of a change in fixed cost on price and output in the short run and in the long run under perfect competition.Explain why under perfection competition output prices will change by less than the change in production cost in the short run, but by the full amount of the change in production cost in the long run.Describe the three possible effects on the costs of the factors of production that expansion or contraction of a perfectly competitive industry may have and illustrate the resulting long-run industry supply curve in each case.Explain why in long-run equilibrium in a perfectly competitive industry firms will earn zero economic profit.Distinguish between economic profit and accounting profit.

0 kommentar(er)

0 kommentar(er)